Staff Risk Data Scientist

Company Overview

Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With approximately 100 million customers worldwide using products such as TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible.

Job Overview

Intuit’s Consumer Group, including TurboTax, empowers millions of individuals to take control of their finances. TurboTax simplifies tax preparation and enables our customers to file with confidence. We leverage data and insights to innovate and enhance our consumer offerings.

Now, we are expanding our focus to Consumer Lending within the Consumer Group, including TurboTax, and require a strategic leader to build AI/ML models for consumer lending. This role will be crucial in supporting our consumer lending initiatives, while navigating the complexities of Fintech Risk, alongside our core tax preparation business. If you are passionate about being a part of a high-performing team that drives results through data-driven insights in consumer lending spaces, and understands the unique risks within Fintech, this role is for you.

As a Staff Data Scientist in the Fintech Risk team, you will be in a highly influential position to inform Consumer lending product strategy and drive maximum business results.

Responsibilities

● Perform hands-on data analysis and modeling to derive meaningful conclusions and solve complex problems of lending. Extract insights and knowledge from structured and unstructured data using various techniques, including statistical analysis, machine learning, and data visualization in service to driving business decisions.● Run regular A/B tests, gather data, perform statistical analysis, draw conclusions on the impact of product experiences, and communicate results to peers and leaders to measure and optimize execution of data-driven strategies in emerging areas of the consumer lending roadmap.● Utilize models and develop advanced experimentation methods, such as synthetic controls, propensity score matching techniques, etc., to establish causality and measure product performance.● Manage data integration and engineering with the Product platform for data hygiene.● Partner closely with credit and fraud risk policy teams in deploying models and inferring results by monitoring the performance and effectiveness of strategies.● Provide guidance and support to business leaders and stakeholders on how best to harness available data in support of critical business needs and goals in the standardization of reporting and strategy.● Drive strategic thinking and cross-functional alignment around data-driven approaches to optimizing the lending funnel.● Influence the team's roadmap by sharing findings with the rest of the company and driving and verifying change in our marketing channel spend.● Mentor junior analysts to raise the bar across the organization.

Qualifications

● 5-7 years of experience working in web, product, marketing, or other related analytics fields, Preferred experience in lending or fintech domain● Ability to tell stories with data, educate effectively, and instill confidence, motivating stakeholders to act on recommendations.● Proven ability to apply scientific methods to solve real-world problems on web-scale data.● Strong business and product sense: delight in shaping vague questions into well-defined analyses and success metrics that drive business decisions.● Advanced proficiency in SQL, Tableau, and Excel, with expertise in modern advanced analytical tools and programming languages such as Python.● Experience in defining metrics and instrumenting data tracking in clickstream.● Excellent problem-solving skills and end-to-end quantitative thinking.● Ability to manage multiple projects simultaneously to meet objectives and key deadlines.● A great storyteller and communicator who can build relationships with a diverse set of stakeholders, including both technical and non-technical colleagues.● MS in Statistics, Mathematics, Computer Science, Economics, Operations Research, or equivalent work experience is preferred.

Intuit provides a competitive compensation package with a strong pay for performance rewards approach. The expected base pay range for this position is Bay Area California $186,000-252,000. This position will be eligible for a cash bonus, equity rewards and benefits, in accordance with our applicable plans and programs (see more about our compensation and benefits at Intuit®: Careers | Benefits). Pay offered is based on factors such as job-related knowledge, skills, experience, and work location. To drive ongoing fair pay for employees, Intuit conducts regular comparisons across categories of ethnicity and gender.

We use the technology for good to help small businesses and consumers.

Ercan Kaynakca Staff Data Crypto Analyst

Related Content

-

-

GED is a weeklong code-a-thon that brings together Intuit technologists from all over the world to innovate and collaborate on projects they’re passionate about.

-

Intuit has built foundational capabilities for collecting, processing and transforming raw data into a connected mesh of high quality data. Those capabilities are enabling our technologists to build personalized experiences, with speed and at scale, to deliver on our mission to power prosperity around the world

-

Article

Our approach to hybrid work

Intuit embraces a hybrid way of working that brings the best of in-person collaboration and connections together with the flexibility of virtual work.

-

For Intuit, turning data into actionable insights is pivotal to our success in delivering awesome experiences to 100 million customers That’s why we’ve developed an internal generative AI powered tool called Query Kickstart to improve speed to insight by accelerating SQL query authoring for our data workers.

-

Intuit is using generative AI to power our internal developer platforms to enable our software engineers and data workers to be more effective and efficient.

-

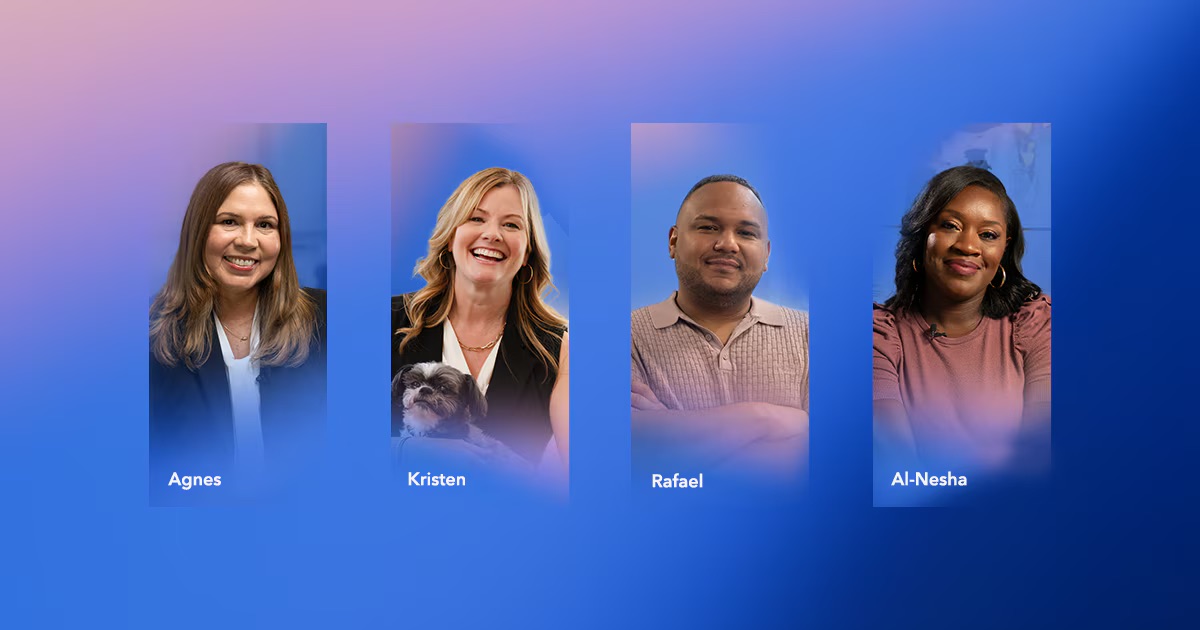

4 Ways Intuit helped me start a successful tax career

-

Blog

Improving Tax Skills

I was ready to up my tax game, that's why I joined Intuit

-

Blog

Career Path

Accelerate Your Career Path Inside Intuit

-

Video

Offices of the future

We're building the workforce and workplace of the future by investing in our sites around the world. This video shows how our office designs and features spark innovation for our global teams.

-

-

-

Building a true platform culture to solve customer problems

-

Blog

Using AI Together

11 Things we've learned about using AI together

-

AI skills to boost your tech career

-

Blog

Intuit Survey

US high school students want financial education at school

-

Blog

Velocity Hacks

Velocity Hacks to work harder not smarter

-

How Intuit helps tax and bookkeeping pros do their best work

-

Blog

Tax Experiences

The Role of AI in Delivering Personalized Tax Experiences

-

Blog

Career Tips

Navigating your career path, tips for engineers

-

Blog

Hybrid Work

How Intuit's hybrid work model is evolving

-

From intern to director; coding is a key aspect of Intuit.

-

Blog

Future of Fintech

How Intuit is shaping the future of fintech

-

Intuit's new tools to improve business finances

-

Roughly 7,500 participants worked together at Intuit’s biannual week-long event to turn ideas into innovative solutions for approximately 100 million consumer and business customers.

-

Blog

Thomas Ranese as CMO

Intuit Appoints Thomas Ranese as CMO

-

Blog

Meet James Harris

From an Atlanta Barbershop to Intuit’s Strategic Accounts

-

Petagae Butcher on paving a career in tech

-

Israel's top 10 best high tech companies for parents

-

Toronto's inclusive workplace design inspired by indigenous ties

-

-

-

Blog

Internal Mobility

Internal Mobility Can Enhance Skill Development

-

-

At Intuit, you can build AI-powered solutions while shaping a career path that creates unparalleled impact

-

Article

Benefits

We support our employees by offering benefits you need to stay healthy, achieve financial security, and enjoy peace of mind for you and your family.

-

Blog

Intuit introduces Intuit Enterprise Suite to help businesses grow, streamline operations, and scale

We're further expanding mid-market offerings with an all-in-one solution that serves larger and more complex businesses and fuels their growth.

-

To drive continuous AI innovation, businesses should consider three key strategies: rigorous technical reviews, cross-functional AI integration, and structured conflict resolution.

-

Intuit is focused on fostering innovation by encouraging an entrepreneurial mindset among its technologists, allowing them to build and make mistakes, and highlighting the increasing expectations for new graduates entering the tech industry.

-

Intuit's Chief Data Officer, Ashok Srivastava, discusses the company's strategic use of AI and data science to improve financial products, emphasizing employee education and ethical AI practices.

-

Revolutionizing Knowledge Discovery with GenAI to Transform Document Management

-

Building extensible capabilities to elevate developer experience and seamlessly adapt to customers' changing needs have been critical transformations in Intuit's platform journey.

-

ntuit uses AI to empower small business success with personalized data insights and tools that drive growth, emphasizing data privacy and responsible AI to build trust.

-

Uttam Ramamurthy, principal software engineer and one of the first builder catalyst hires at Intuit India, speaks about his interview experience including various assessments—that gives candidates a competitive edge.

-

-

Video

Intuit Academy

Start your career as a remote tax preparer or bookkeeper through our Intuit Academy program. The program consists of self-paced online courses, followed by an exam. Upon passing the exam, you will receive a badge that you can easily display to advance your career in the industry.

-

The tax code is complicated. The good news is that Intuit tax experts help people confidently tackle tax time.

-

Intuit's, GED Spring 2025, week-long code-a-thon expanded on AI-related projects to push the boundaries of what can be done for customers.

-

Excitement and skepticism will mark the year ahead, as AI-powered experiences proliferate and customers ultimately decide what’s best for them.

Jobs For You

You haven't viewed any jobs yet. Start exploring now to find the perfect opportunity for you!

View all of our available opportunitiesYou haven't saved any jobs yet. Start exploring now to find the perfect opportunity for you!

View all of our available opportunitiesSign Up for Job Alerts

Be the first to find out about open jobs that fit what you're looking for.