Seasonal French Bilingual Tax Expert- Canada Remote

Location(s) Available to work remotely throughout Canada, including these locations

Job ID 2025-69516

Overview

Ready for a new seasonal opportunity with the #1 tax software company in Canada?

If you have experience as a tax professional, are highly motivated and have excellent communication skills, then we need you to help our clients complete their taxes using Intuit TurboTax products. You will advance our goal of “Powering Prosperity Around the World” by providing expert guidance and support to our clients. You will also play an important role in our effort to enhance our brand by delighting our clients and empowering them to prepare their taxes.

To apply just click Get Started and fill out our short application form.

Une possibilité d’emploi saisonnier où vous aurez à utiliser le logiciel d’impôt n° 1 au Canada vous intéresse?

Si vous avez de l’expérience en tant que préparateur de déclarations de revenus, que vous êtes très motivé et que vous avez d’excellentes compétences en communication, nous avons besoin de vous pour aider nos clients à remplir leurs déclarations de revenus à l’aide des logiciels Turbo Impôt d’Intuit. Ainsi, vous participerez à l’atteinte de notre objectif de prospérer partout dans le monde, en fournissant des conseils d’experts et un soutien à nos clients. Également, vous jouerez un rôle important dans nos efforts visant à améliorer notre marque en répondant aux attentes de nos clients et en leur donnant les moyens de préparer adéquatement leurs déclarations de revenus.

Pour postuler, cliquez simplement sur Commencer et remplissez notre court formulaire de candidature.

About This Role

As a Tax Expert with Intuit you'll work directly with clients to prepare their tax return, provide tax guidance, and help troubleshoot their tax questions. This is a virtual, seasonal, and client facing position in which you'll have access to our virtual tools and resources, as well as opportunities to collaborate with experts and provide updates on assigned customers. At the end of the season we offer opportunities to work with us again for following seasons.

- 3+ years paid professional tax preparation experience using professional tax preparation software

- Minimum of 50 tax returns prepared per tax season for the last 3 years

- Bilingual proficiency (English and French + read, write, speak) required

- Strong customer service and customer experience acumen

- Experience preparing and filing end-to-end customer personal returns consisting of a variety of topics, including employment, self-employment, rental, investments, T1135, foreign income, and all credits/deductions

En tant qu'expert fiscal chez Intuit, vous travaillerez directement avec les clients pour préparer leur déclaration de revenus, fournir des conseils fiscaux, rechercher et résoudre des questions fiscales. Il s'agit d'un poste virtuel, saisonnier et orienté client pour les déclarations de revenus des particuliers. Vous aurez accès à nos outils et ressources virtuels, ainsi qu'à des opportunités de collaboration avec des experts et de fournir des mises à jour sur les clients assignés. À la fin de la saison, nous offrons des opportunités de retravailler avec nous pour les saisons suivantes.

- Plus de 3 ans d'expérience professionnelle rémunérée en préparation de déclarations de revenus à l'aide d'un logiciel professionnel de préparation de déclarations de revenus

- Minimum de 50 déclarations de revenus préparées par saison fiscale au cours des 3 dernières années

- Maîtrise du bilinguisme (anglais et français + lire, écrire, parler) requise

- Fort sens du service client et de l'expérience client

- Expérience dans la préparation et la production de déclarations personnelles de bout en bout portant sur une variété de sujets, incluant l'emploi, le travail indépendant, la location, les investissements, le T1135, les revenus étrangers et tous les crédits/déductions.

I'm able to work at home, get exposure to a vast pool of issues that I would not normally encounter in my own practice, learn a great deal and get supplemental income.

Current employee Senior Tax Expert - Marksville, LA

Benefits

Responsibilities

Job Overview

Intuit est la plateforme technologique financière mondiale qui favorise la prospérité des personnes et des communautés que nous servons. Avec environ 100 millions de clients dans le monde utilisant des produits tels que TurboImpôt, Credit Karma, QuickBooks et Mailchimp, nous croyons que tout le monde devrait avoir la possibilité de prospérer. Nous ne cessons jamais de travailler pour trouver de nouvelles façons innovantes de rendre cela possible.

Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With approximately 100 million customers worldwide using products such as TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible.

Responsibilities

- Dans ce rôle, vous aiderez nos clients à remplir leurs déclarations de revenus en utilisant les produits Intuit TurboImpôt. En fournissant des conseils fiscaux et en examinant les déclarations de revenus personnelles des clients qui remplissent eux-mêmes leur déclaration de revenus, en préparant des déclarations de revenus complètes et en gérant les demandes de produits/logiciels, vous travaillerez à accélérer notre objectif de favoriser la prospérité dans le monde entier.

- Vous utiliserez les sites Web gouvernementaux, les ressources professionnelles et l'expertise de l'équipe pour rechercher et fournir la bonne réponse au client dans des termes qu’il comprendra.

- • Il s'agit d'un rôle virtuel en contact avec la clientèle, vous utiliserez donc notre logiciel de communication vidéo de pointe pour interagir avec les clients et vous documenterez vos interactions pour conserver des dossiers précis.

- In this role, you will help our customers complete their taxes using Intuit TurboTax products. By providing tax guidance and reviewing personal tax returns for customers completing their tax return on their own, full service return preparation, and managing product/software inquiries, you will be working toward accelerating our goal of Powering Prosperity Around the World.

- You will utilize government websites, professional resources, and team expertise to seek out and deliver the right answer to the customer in terms they will understand.

- This is a virtual, customer-facing role, so you will use our state of the art video communication software to interact with customers, and you will document your interactions to maintain accurate records.

Qualifications

- En tant qu'expert en impôts, vous avez un minimum de deux (2) ans d'expérience rémunérée en préparation d'impôts professionnels.

- Il vous sera demandé de fournir votre identifiant de représentant (RepID) de l’ARC pour permettre votre utilisation du service Représenter un client de l'ARC lors de votre intégration réussie.

- Vous avez de l'expérience dans l'utilisation de logiciels fiscaux professionnels pour préparer et produire des déclarations de revenus personnelles, y compris celles avec des éléments complexes tels que l'emploi, le travail indépendant, les revenus locatifs, les investissements, les formulaires T1135, les revenus étrangers et divers crédits et déductions.

- Vous êtes passionné par l'idée d'aider les clients à naviguer dans les complexités de la fiscalité et vous vous engagez à améliorer notre marque en ravissant nos clients et en leur donnant les moyens de préparer leurs impôts.

- Vous possédez d'excellentes compétences en service à la clientèle et vous êtes ravi d'interagir avec les clients via des outils vidéo et audio de manière professionnelle, amicale et confiante.

- Vous devez être disposé et disponible à travailler selon un horaire flexible avec un minimum de vingt (20) heures par semaine.

Qualifications complémentaires :

- Expérience dans la préparation de déclarations d'impôts de sociétés (T2).

- Expérience dans la préparation de déclarations d'impôts du Québec (TP1).

Compétences et aptitudes :

- Expertise fiscale – Démontre une compréhension fondamentale des lois et des concepts fiscaux. Capacité avérée à rechercher des opportunités d'apprentissage supplémentaires pour accroître les connaissances et se renseigner sur les changements d'une année à l'autre.

- Communication efficace – Utilise des compétences en communication écrite et verbale pour fournir un service de qualité lors des échanges avec les clients. Pratique l'écoute active pour développer l'empathie et comprendre les points de difficulté des clients.

- Résolution de problèmes complexes – Démontre un engagement à comprendre les problèmes des clients, à tirer parti des outils et des ressources pour assumer une responsabilité totale et résoudre ou escalader le cas échéant, pour un soutien supplémentaire en temps opportun.

- Recherche / Ingéniosité – Démontre de la curiosité et un intérêt pour l'apprentissage continu. Suit avec confiance les procédures et recherche des ressources pour fournir des solutions appropriées à tous les clients.

- Compétence technique – Montre un intérêt à se familiariser avec les outils nécessaires pour le rôle et démontre une capacité de base à dépanner les problèmes.

Intuit offre un programme de rémunération concurrentiel basé sur une approche de récompense liée à la performance. L’échelle salariale de base prévue pour ce poste est de 24,50 $/heure à 33,50 $/heure à l’Î.-P.-É., 24,50 $/heure à 33,50 $/heure en C.-B., et 24,50 $/heure à 33,50 $/heure en Nouvelle-Écosse. Ce poste est admissible à une prime en argent, à des récompenses en actions ainsi qu’à des avantages sociaux, conformément à nos régimes et programmes applicables (voir plus de détails sur notre rémunération et nos avantages à Intuit® : Carrières | Avantages sociaux). La rémunération offerte est établie en fonction de facteurs tels que les connaissances liées au poste, les compétences, l’expérience et le lieu de travail. Afin d’assurer l’équité salariale de façon continue, Intuit effectue des comparaisons régulières selon les catégories d’origine ethnique et de genre.

- As a Tax Expert, you have a minimum of 2+ years of paid professional tax preparation experience.

- You will be asked to provide your CRA RepID (representative identifier) to allow your use of the CRA Represent a Client service upon successful onboarding.

- You have experience utilizing professional tax software to prepare and file personal tax returns, including those with complex elements such as employment, self-employment, rental income, investments, T1135 forms, foreign income, and various credits and deductions.

- You are passionate about helping clients navigate the complexities of taxation, and you’re committed to enhancing our brand by delighting our customers and empowering them to prepare their taxes.

- You possess excellent customer service skills, and you are excited to interact with customers through video and audio tools in a professional, friendly, and confident manner.

- You must be willing and available to work a flexible schedule with a minimum of 20 hours per week.

Asset Qualifications:

- Experience preparing Business Tax (T2) Returns.

- Experience preparing Quebec Tax (TP1) Returns.

Skills & Abilities:

- Tax Expertise - Demonstrates a fundamental understanding of tax laws and concepts. Proven ability to seek out additional learning opportunities to increase knowledge and learn about year-over-year changes.

- Effective Communication - Uses written and verbal communication skills to provide quality service when speaking with customers. Practices active listening to develop empathy and understand customer pain points.

- Complex Problem Solving - Demonstrates commitment to understanding customer problems, leveraging tools and resources to take extreme ownership and solve or escalate as appropriate for additional support in a timely manner.

- Research / Resourcefulness - Demonstrates curiosity and interest in continuous learning. Confidently follows procedures and looks for resources to deliver suitable solutions for all customers.

- Technical Acumen - Shows interest in learning about the tools needed for the role and demonstrates basic ability to troubleshoot issues. Intuit provides a competitive compensation package with a strong pay for performance rewards approach. The expected base pay range for this position is PEI $24.50/hour - $33.50/hour, BC $24.50/hour - $33.50/hour, Nova Scotia $24.50/hour - $33.50/hour This position will be eligible for a cash bonus, equity rewards and benefits, in accordance with our applicable plans and programs (see more about our compensation and benefits at Intuit®: Careers | Benefits). Pay offered is based on factors such as job-related knowledge, skills, experience, and work location. To drive ongoing pay equity for employees, Intuit conducts regular comparisons across categories of ethnicity and gender.

Our culture and entrepreneurial spirit have earned us a spot on “Best Companies to Work For” lists year after year. Join us in our mission to power prosperity around the world.

EOE AA M/F/Vet/Disability. Intuit will consider for employment qualified applicants with criminal histories in a manner consistent with requirements of local law.

Related job openings

Saved jobs

You haven't saved any jobs yet. Start exploring now to find the perfect opportunity for you!

View all of our available opportunitiesRelated Content

-

-

GED is a weeklong code-a-thon that brings together Intuit technologists from all over the world to innovate and collaborate on projects they’re passionate about.

-

Intuit has built foundational capabilities for collecting, processing and transforming raw data into a connected mesh of high quality data. Those capabilities are enabling our technologists to build personalized experiences, with speed and at scale, to deliver on our mission to power prosperity around the world

-

Article

Our approach to hybrid work

Intuit embraces a hybrid way of working that brings the best of in-person collaboration and connections together with the flexibility of virtual work.

-

For Intuit, turning data into actionable insights is pivotal to our success in delivering awesome experiences to 100 million customers That’s why we’ve developed an internal generative AI powered tool called Query Kickstart to improve speed to insight by accelerating SQL query authoring for our data workers.

-

Intuit is using generative AI to power our internal developer platforms to enable our software engineers and data workers to be more effective and efficient.

-

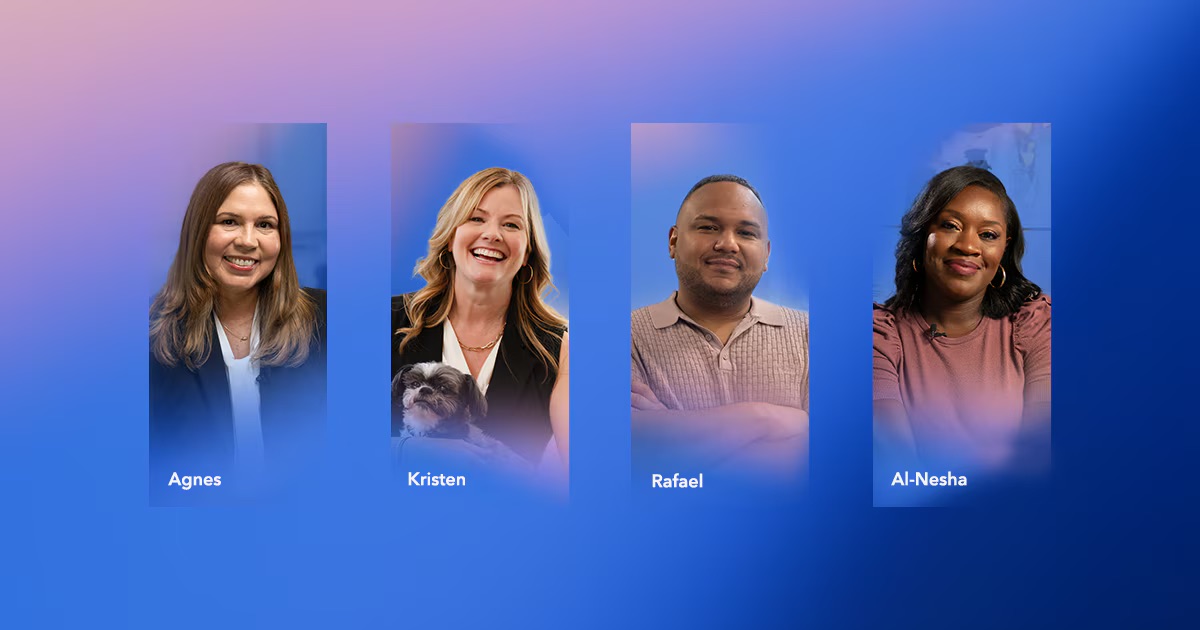

4 Ways Intuit helped me start a successful tax career

-

Blog

Improving Tax Skills

I was ready to up my tax game, that's why I joined Intuit

-

Blog

Career Path

Accelerate Your Career Path Inside Intuit

-

Video

Offices of the future

We're building the workforce and workplace of the future by investing in our sites around the world. This video shows how our office designs and features spark innovation for our global teams.

-

-

-

Building a true platform culture to solve customer problems

-

Blog

Using AI Together

11 Things we've learned about using AI together

-

AI skills to boost your tech career

-

Blog

Intuit Survey

US high school students want financial education at school

-

Blog

Velocity Hacks

Velocity Hacks to work harder not smarter

-

How Intuit helps tax and bookkeeping pros do their best work

-

Blog

Tax Experiences

The Role of AI in Delivering Personalized Tax Experiences

-

Blog

Career Tips

Navigating your career path, tips for engineers

-

Blog

Hybrid Work

How Intuit's hybrid work model is evolving

-

From intern to director; coding is a key aspect of Intuit.

-

Blog

Future of Fintech

How Intuit is shaping the future of fintech

-

Intuit's new tools to improve business finances

-

Roughly 7,500 participants worked together at Intuit’s biannual week-long event to turn ideas into innovative solutions for approximately 100 million consumer and business customers.

-

Blog

Thomas Ranese as CMO

Intuit Appoints Thomas Ranese as CMO

-

Blog

Meet James Harris

From an Atlanta Barbershop to Intuit’s Strategic Accounts

-

Petagae Butcher on paving a career in tech

-

Israel's top 10 best high tech companies for parents

-

Toronto's inclusive workplace design inspired by indigenous ties

-

-

-

Blog

Internal Mobility

Internal Mobility Can Enhance Skill Development

-

-

At Intuit, you can build AI-powered solutions while shaping a career path that creates unparalleled impact

-

Article

Benefits

We support our employees by offering benefits you need to stay healthy, achieve financial security, and enjoy peace of mind for you and your family.

-

Blog

Intuit introduces Intuit Enterprise Suite to help businesses grow, streamline operations, and scale

We're further expanding mid-market offerings with an all-in-one solution that serves larger and more complex businesses and fuels their growth.

-

To drive continuous AI innovation, businesses should consider three key strategies: rigorous technical reviews, cross-functional AI integration, and structured conflict resolution.

-

Intuit is focused on fostering innovation by encouraging an entrepreneurial mindset among its technologists, allowing them to build and make mistakes, and highlighting the increasing expectations for new graduates entering the tech industry.

-

Intuit's Chief Data Officer, Ashok Srivastava, discusses the company's strategic use of AI and data science to improve financial products, emphasizing employee education and ethical AI practices.

-

Revolutionizing Knowledge Discovery with GenAI to Transform Document Management

-

Building extensible capabilities to elevate developer experience and seamlessly adapt to customers' changing needs have been critical transformations in Intuit's platform journey.

-

ntuit uses AI to empower small business success with personalized data insights and tools that drive growth, emphasizing data privacy and responsible AI to build trust.

-

Uttam Ramamurthy, principal software engineer and one of the first builder catalyst hires at Intuit India, speaks about his interview experience including various assessments—that gives candidates a competitive edge.

-

-

Video

Intuit Academy

Start your career as a remote tax preparer or bookkeeper through our Intuit Academy program. The program consists of self-paced online courses, followed by an exam. Upon passing the exam, you will receive a badge that you can easily display to advance your career in the industry.

-

The tax code is complicated. The good news is that Intuit tax experts help people confidently tackle tax time.

-

Intuit's, GED Spring 2025, week-long code-a-thon expanded on AI-related projects to push the boundaries of what can be done for customers.

-

Excitement and skepticism will mark the year ahead, as AI-powered experiences proliferate and customers ultimately decide what’s best for them.

Sign Up for Job Alerts

Be the first to find out about open jobs that fit what you're looking for.